Economic Overview

The North Central Massachusetts Development Corporation

For businesses, travelers and residents alike, the North Central Massachusetts region offers the opportunity to experience New England at its finest.

For more information about the NCMDC visit www.ChooseNorthCentral.com or contact Sandie Cataldo, Economic Development Manager at 978.353.7607 x232.

Tourism

North Central Massachusetts has much to offer its visitors from serene farmlands and rivers to the energetic Great Wolf Lodge. Here you can spend a day skiing at Wachusett Mountain Ski Area or take your kids to experience all that Davis’ Farm Family Adventure has to offer. The region is filled with a rich history and fascinating museums ready for you to explore. With all the attractions that the region has to offer, you’ll have a hard time picking what to do. Whatever your interest, and whatever your age, you’ll find the perfect destination – and not so far away. VisitNorthCentral.com for more information on everything the region has to offer visitors and residents.

Visit North Central Massachusetts (VNCM) is the official regional tourism organization serving North Central Massachusetts. The organization’s primary mission is to educate the traveling public, tourists, and residents of North Central Massachusetts about the many historical, cultural, and hospitality related sites within this scenic New England Region. Through this mission VNCM works collectively with local attractions, hospitality businesses and local communities to market the North Central region as a destination and provide information and services to the traveling public.

Since its founding, in 1994, Visit North Central Massachusetts has been very successful in branding the region and growing the economic impact of the industry. In 2004, tourism represented approximately 286 jobs and $2 million in wages in the region’s hospitality industry. Today, it accounts for over 800 jobs and over $24 million in wages. In 2004, VNCM generated $14.3 million of economic activity and $7 million in direct expenditures by visitors and $5.4 million in secondary spending. Today, tourism in North Central Massachusetts conservatively generates over $131 million of direct spending and over $7.6 million in tax revenues for our communities.

Whether you’re planning a week-end getaway or vacation, making arrangements to bring a tour group in by bus or need help with planning a meeting or sports event, the experienced staff at Visit North Central Massachusetts are available to assist you. Contact Visit North Central Massachusetts at 978.3537604.

Manufacturing

North Central Massachusetts has a rich history in Manufacturing Tradition, including the birthplace of American plastics industry in Leominster, the area is home to more than 430 manufacturers, including dozens of multinational corporations. Companies range from the world class plastics industry cluster of more than 140 companies to pharmaceuticals to photonics and paper, as well as biomedical devices. A strong and stable business base exists here, as well as rapidly growing industrial/commercial areas such as Devens Business Park.

North Central Massachusetts is unique among workforce areas in the state in that it has double the number of manufacturing jobs as a percentage of the private labor force. Fully one-third of all private wages paid in the region are from manufacturing jobs. The region also boasts the largest plastics industry cluster in the Northeast. This is why we say that North Central Massachusetts is “Where Manufacturing Matters.”

The North Central Massachusetts Chamber of Commerce and its affiliates remain committed to supporting and growing this critical sector of our economy. Contact the Chamber at 978.353.7600 for assistance or more information on resources available.

MANUFACTURING MATTERS

Electric

Northeast Energy Partners has teamed up with the North Central Massachusetts Chamber of Commerce to offer members an alternative way to buy energy. You can join one of the largest energy buying groups in Northeast Energy Partner’s 10-year history, with over 3,000 small businesses. Lock in your electric rate and keep these low prices for the next several years!

Join the Northeast Energy Partners Electricity Buying Group today and receive these benefits….

- The power of one of the largest buying groups in the state.

- Enjoy a low & stable, fixed rate for the next 3 years.

- Have the peace of mind to know you locked in at 6-year lows!

- Receive the same great service you’ve always had from your local utility company and even the billing stays the same

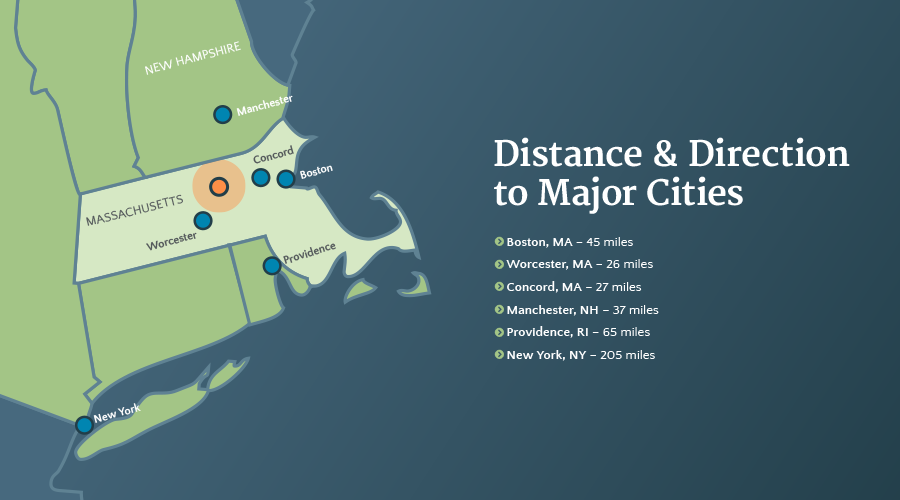

Location & Transportation

North Central Massachusetts is strategically located within an hour’s drive from Metro Boston and thirty minutes from Metro Worcester with easy accessibility via Route 2 serving as an east-west corridor with fast connections to Route 496, 190 and 91 for north-south travel. Commuting is easy with in the region and for Boston commuters, the MBTA offers train service from intermodal centers in downtown Fitchburg and West Fitchburg extending into Boston with convenient stations in North Leominster Shirley and Ayer. Even air travel is convenient in North Central Massachusetts with private jet service at the Fitchburg Regional Airport. The Worcester Regional Airport connects Central Massachusetts the world. The airport offers 5 daily roundtrip service through JetBlue, American Airlines, and Delta Air Lines, with connections to over 120 destinations around the globe. Major international airports in Boston, Providence and Manchester, N.H. are no more than 90 minutes away. Freight rail services are primarily provided to the North Central region by three carriers: CSX; Pan Am; and Providence-Worcester. These carriers have multiple connections with each other and provide very thorough coverage throughout the region and beyond it to the entire country. Public Transportation is provided to most of the communities in the region by the Montachusett Regional Transit Authority (MART).

Local Airports

- Fitchburg Airport (municipally owned, public use)

- Gardner Municipal Airport

- Orange Municipal Airport

- Shirley Airport (privately owned)

- Sterling Airport (privately owned, public use)

International and Regional Airport Hubs

- Logan Airport, Boston, MA

- Manchester Airport, Manchester NH

- T.S. Green, Providence, RI

- Worcester Airport, Worcester, MA

Passenger Rail Service

Freight Rail Service

CSX:

Operates a freight rail line from Leominster to their rail yard in Framingham, as well as freight service from Ayer to Worcester. The connections in Framingham and Worcester are linked as part of a CSX system that runs from Boston along the I-90 corridor to Albany, NY and from there to NYC, the entire Eastern seaboard, and as far West as Chicago, St. Louis, Memphis, and New Orleans.

PAN AM:

Formerly known as Guilford Rail, Pan Am operates the primary rail line along Route 2 as far as Albany, and also along Route 91 from CT into VT. Along with their access rights to other rail lines, they can provide freight service from North Central MA to Boston or Albany, and from White River Junction, VT to New Haven, Waterbury, and Derby, CT, with a connection at their own line in Greenfield, MA. Pan Am and Norfolk Southern recently announced a partnership to make improvements to the entire rail system between Albany and Boston, with improvements to the tracks and facilities expected to improve transport times.

PROVIDENCE-WORCESTER:

Their primary regional line runs from Gardner to Worcester, with connections to other operators in both locations. Also operates lines through RI and CT, as well as providing freight service up through VT to the Canadian border.

Bus Routes

Montachusett Regional Transit Authority (MART) Bus

Click here for complete schedule information and an interactive route map.